Why Liquidity Is the Real Competitive Advantage

In real estate, high returns are not enough. Liquidity is the true competitive advantage that protects capital, reduces risk, and gives investors flexibility across every market cycle. In real estate, many people talk about returns. Very few talk about liquidity. Yet liquidity is what: protects capital, reduces downside risk, and gives investors real freedom of action. Without liquidity, even a “good investment” can become a trap.

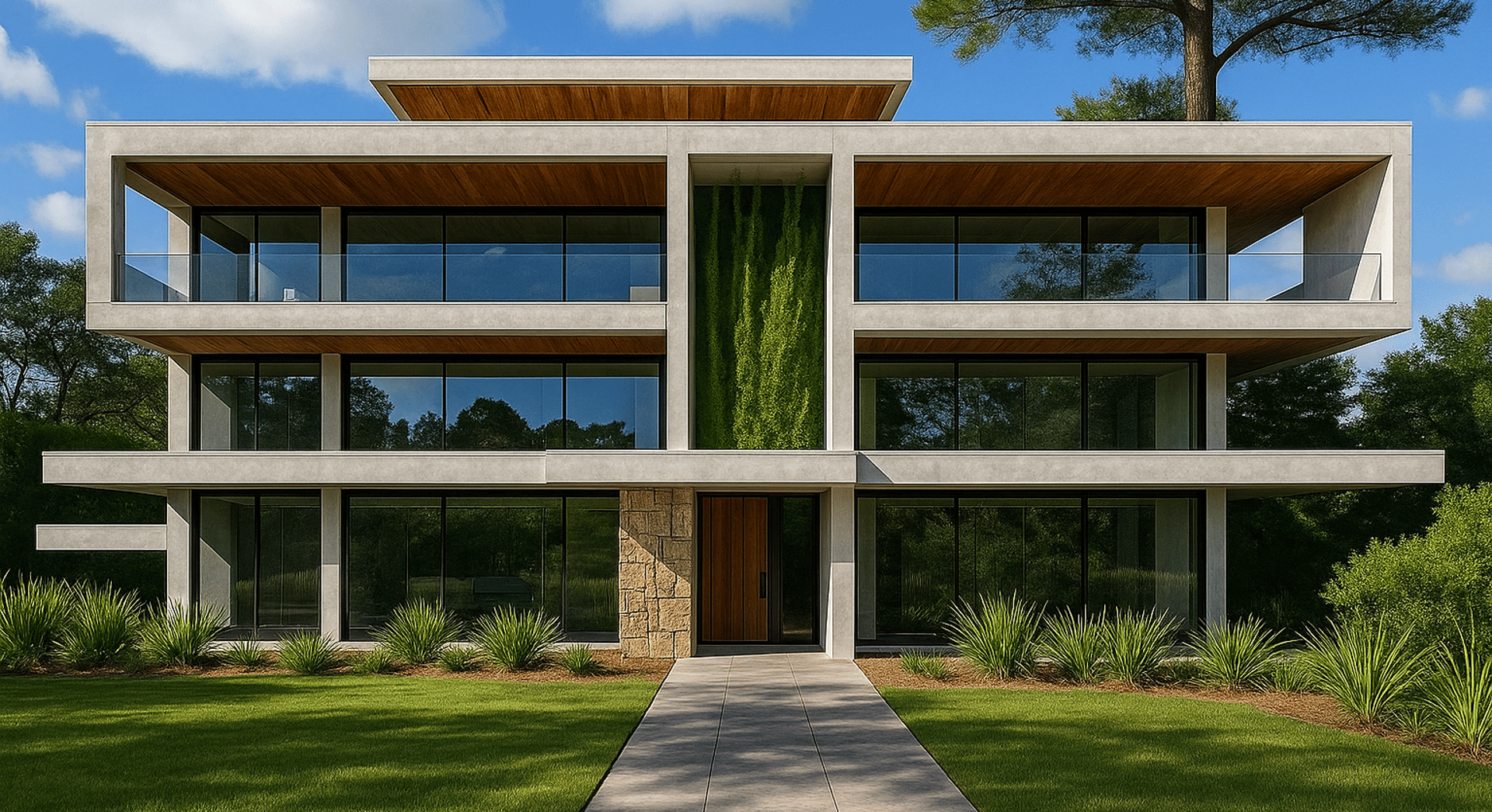

REAL ESTATE INVESTMENT

Christos Boubalos - poli.gr

12/25/2025

What liquidity really means in real estate

Liquidity does not simply mean that a property can be sold “eventually.”

It means:

it can be sold when needed,

within a reasonable timeframe,

without requiring aggressive price discounts.

A property is liquid when:

it appeals to a broad buyer pool,

it sits in a structurally sound location,

it has a functional layout,

and it remains relevant regardless of market conditions.

Why yield without liquidity is dangerous

High yield on paper does not equal safety.

Properties that:

offer strong returns, but

appeal to a narrow audience,

often:

stagnate on the market,

require heavy repricing,

trap capital when conditions change.

Yield is a number.

Liquidity is an exit.

Professionals always think about the exit first

Before buying, serious investors ask:

“Who will buy this property from me in the future?”

If the answer is:

“a very specific buyer,” or

“if the right person appears,”

liquidity is weak.

Strong assets:

sell to many,

not to a few.

Liquidity reduces cycle-related stress

Markets rise and fall.

That will never change.

What does change is:

who can wait,

who is forced to act,

who sells under pressure.

When a property is liquid:

time works in your favor,

decisions are not rushed,

market volatility becomes manageable.

Liquidity creates calm.

What actually makes a property liquid

In practice, liquidity comes from:

strong micro-location,

functional floor plan,

natural light and orientation,

construction quality,

energy efficiency,

flexibility of use.

Not from:

“opportunistic pricing,”

excessive specialization,

or speculative future demand.

Why liquidity is a true competitive advantage

In stressed markets:

illiquid investors get stuck,

liquid investors choose.

Liquidity allows you to:

exit on your terms,

restructure a portfolio,

capitalize on new opportunities.

It is not passive.

It is strategic leverage.

The professional perspective

At Poli Real Estate, liquidity is a core filter before any investment decision.

We look not only at:

how a property performs today,

but primarily at:

how easily it can be converted back into capital tomorrow.

Because the real power of an investor lies in optionality.

Conclusion

Yield matters.

But it is not enough.

In real estate:

liquidity protects capital,

liquidity buys time,

liquidity creates opportunity.

The real competitive advantage is not earning slightly more—but being able to move when others cannot. And that advantage comes only from liquidity.

Brokerage

Contact

info@poli.gr

+30-6972-666688

+30-6972-885885

© 2025 Poli Real Estate. All rights reserved.